The 2023 AI/ML Investment Priorities research study from Verta Insights examined trends in how macroeconomic conditions have impacted spending plans to support AI/ML this year, including the specific factors driving those spending decisions.

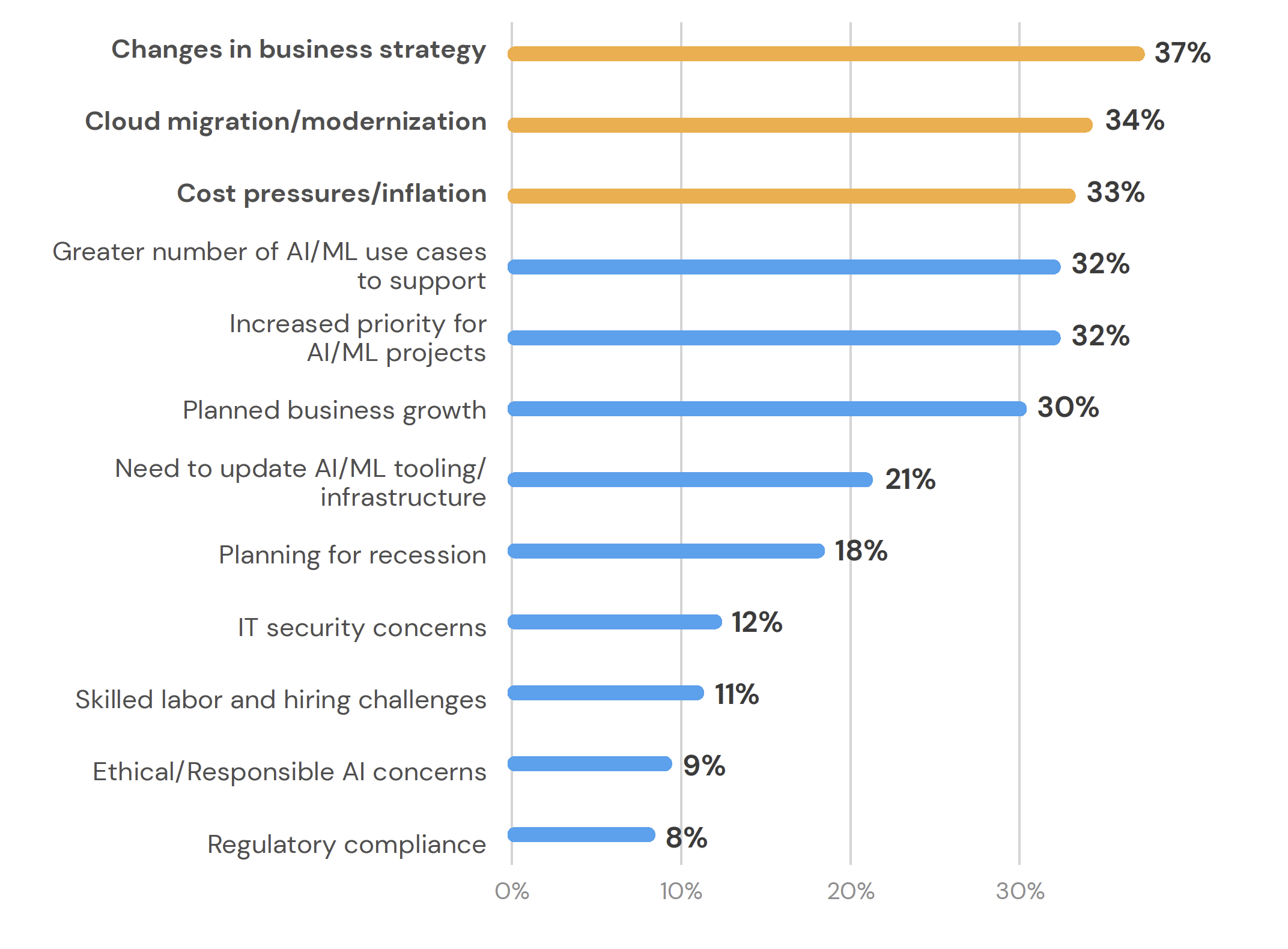

The study, which collected input from over 460 professionals in the field, showed that, overall, the top three factors driving spending decisions for 2023 include changes in business strategy, cloud migration and modernization, and cost pressures or inflation.

The findings also suggest that many companies view AI/ML as integral to their growth strategy. Planned business growth was cited by 30% of respondents as a driver, indicating that organizations are looking to leverage AI/ML as a differentiator in the business.

Factors Driving Spending on AI/ML in 2023

Where Leading and Lagging Performers Differ

The research also revealed differences in investment priorities between leading performers (organizations that always/usually meet their financial targets) and lagging performers (which sometimes/rarely/never meet targets).

Leading performers more frequently cited an increased priority for AI/ML projects, while lagging performers more frequently cited cost pressures or inflation as a leading driver. One way to interpret this result is that where a company is currently focusing its investments depends on how far along it is in its digital transformation journey.

For example, organizations that, at present, are just beginning their transformation journey could be reacting to cost pressures and inflation by seeking cost-reduction opportunities. They may be automating human-based tasks on the operational side of ML, such as DevOps tasks like deployment strategies or site reliability engineering (SRE) tasks around monitoring and incident management.

On the other hand, more advanced organizations have already put foundational tools in place to automate machine learning, and these companies are now focused on doubling down on AI/ML projects to pull away from competition.

More Differences on Regulations, Ethical AI

Interestingly, regulatory compliance and ethical AI ranked relatively lower as priorities for investment, cited by 8-9% of respondents, despite being a common concern today in discussions around AI/ML. Currently proposed legislation like the American Data Protection and Privacy Act (ADPPA) and the EU AI Act are raising the specter of new reporting and compliance requirements imminently impacting organizations.

Here again we see differences between leading and lagging performers: 15% of respondents from lagging performers cited ethical and responsible AI concerns as a top-three driver, compared to just 8% of leading performers.

These results might seem counterintuitive, but consider that, across industries, organizations often adopt a reactive approach to regulations, taking steps to comply with new requirements only when the regulations actually come into force. By contrast, we frequently see leading performers proactively putting in place the necessary tools and processes to meet new requirements well in advance of the regulations coming into effect.

The results of our research suggest that leaders may already have put in place required tools, teams and processes to support AI governance and regulatory compliance, and they are now focused on driving additional value and competitiveness from their AI/ML investments. In essence, leaders view impending regulations as an opportunity to get ahead of competitors, whereas laggards are in the position of playing catch-up.

Subscribe To Our Blog

Get the latest from Verta delivered directly to you email.